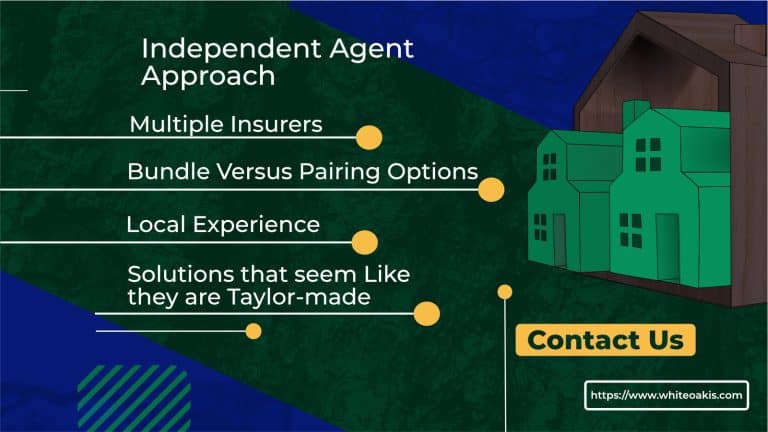

Save time and money in Georgia’s Rising Home insurance Market with White Oak Insurance Services

Navigate Georgia’s Rising Home Insurance Market & save money Get tips on comparing insurers, checking coverage, quotes for insurance premiums, & seeking discounts Start saving now!